Perfectly Inelastic Supply Curve Tax Burden

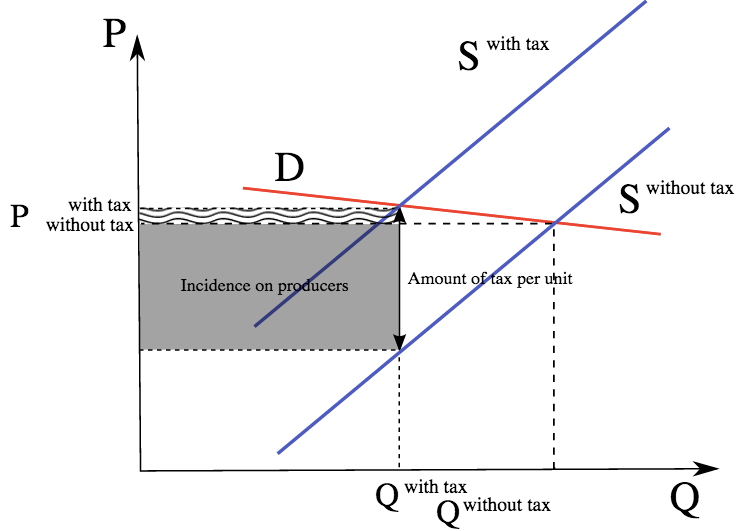

Peds in combination with price elasticity of supply pes can be used to assess where the incidence or burden of a per unit tax is falling or to predict where.

Perfectly inelastic supply curve tax burden. The price elasticity of supply measures how the amount of a good that a supplier wishes to supply changes in response to a change in price. In a manner analogous to. Learning objective the purpose of studying elasticity is to determine how a small change in price may result in either a large or small change in. Which of the following would cause a movement along the supply curve for spaghetti.

That is which of the following causes an increase in the quantity supplied of. C jason welker 2009 1 zurich international school ap microeconomics. Exam study guide format. 60 mc questions worth 6667 of total.

70 minutes to answer. Importance of the concept of elasticity of demand. The concept of elasticity of demand plays a crucial role in the pricing decisions of the business.