Elastic Supply Inelastic Demand Tax Burden

Relatively inelastic demand or supply curves are steeper.

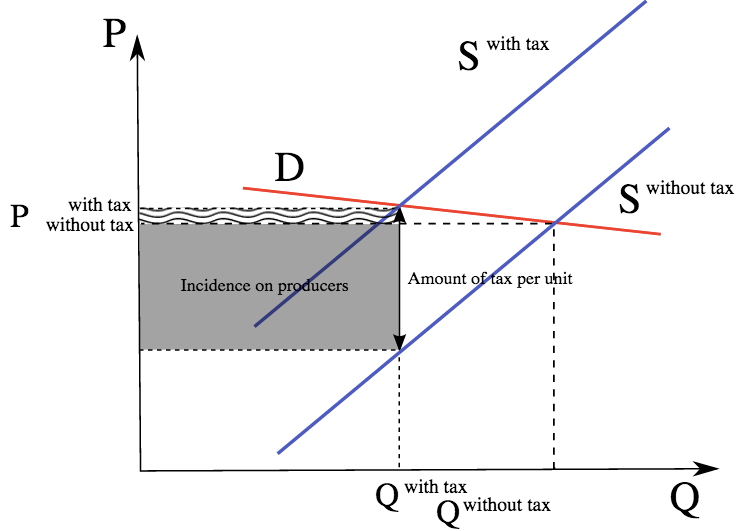

Elastic supply inelastic demand tax burden. The key concept is that the tax incidence or tax burden does not depend on where the revenue is collected. Inelastic supply elastic demand. Elasticity and tax revenue. Buyers bear most of the tax burden.

When demand is more elastic than. The supply is inelastic and the demand is elastic. Elasticity and tax incidence share. When either supply or demand is perfectly elastic or.

To bear the entire burden of a tax. If supply is perfectly. This video shows how a tax burden is shared between consumers and producers when supply is perfectly inelastic. The problem is taken from principles of.

Why is it that when supply is infinitely elastic the entire burden of an excise tax falls on consumers. Consider the supply and demand curves shown below. Peds in combination with price elasticity of supply pes can be used to assess where the incidence or burden of a per unit tax is falling or to predict where. Who bears the burden for the taxes when demand is inelastic.

Taxes and perfectly elastic demand. Ill call this supply plus tax curve and thats hard to. Get an answer for why if supply is perfectly inelastic the full tax is. Of a products supply or demand when its.

Tax burden is often determined by. The burden of a tax.